Wednesday, 17 November 2010

Social Neworking sites should not be used to make recruitment decisions

______________________________________________________

Most jobseekers do not think employers should judge candidates on their personal social media profile, according to research from MyJobGroup.

The research, carried out in conjunction with EPRU (Efficiency and Productivity Research Unit) at the University of Leicester, shows 37% strongly agree that employers should not judge candidates by their social media footprint and just 4.8% strongly disagreeing.

The research also shows 37% strongly agreed potential employers should not look at social media profiles, prior to interview with 4.8% strongly disagreeing.

Meanwhile, 31% would consider taking further action if they were declined for an interview or job due to their social media profile.

Friday, 30 July 2010

Brits three times more likely to embellish their CVs than overseas candidates when applying for roles in the UK Financial Services Sector

CVs as those from the rest of the world. Last month, we released our annual research into CV embellishments, looking through details of almost 6,000 job applications made over the last twelve months. We found that 22% of all British job applicants’ CVs contain a serious untruth or embellishment.

This compared unflatteringly to job applicants from the rest of the world, with the average embellishment rate of just 7%. Job applicants of Asian origin were found to be the most honest, with just 4% of CVs found to contain hidden negative information.

There may be good a reason why British job applicants may appear to be more dishonest than their international counterparts. Applications for more junior positions are more likely to contain hidden negative information, and these tend to be dominated by British jobseekers, with the new pointsbased immigration system creating a substantial barrier for non‐UK job applicants to nonspecialist roles.

More senior positions tend to be offered to a much higher standard of job applicants, from a wider cross‐section of nationalities, with such individuals less likely to conceal negative information, or embellish their work history or academic background.

As such, the discrepancy rate for British applicants ought to be slightly higher, but we are surprised that the figures say they are so much more deceitful than their international counterparts.

In an effort to determine where the worst offenders were coming from, the Powerchex

researchers segmented the data by current address. This revealed that job applicants to the Financial Services Sector from South West England have the worst discrepancy rate, with upwards of one in four CVs from residents of Cornwall, Devon, Somerset, Dorset, Gloucestershire, Wiltshire and Hampshire found to contain at least one discrepancy.

Applications for jobs from those residing in the North of England or the Midlands also had higher than average rates of embellishment, including 62% of UK job applications containing concealed criminal convictions, despite contributing just 9% of the total sample. CVs from residents of Scotland, Wales and North Ireland were the UKs most honest job applicants, with a discrepancy rate of 16%, a full 10% lower than in South West England.

What these figures may indicate is that the economic difficulties of the last 18 months are affecting the confidence of British jobseekers. That 22% of applicants to the Financial Services Sector feel the need to either pad their CV with false achievements, or else conceal negative information from their future employers, should strike fear into recruitment professionals across financial services.

Monday, 7 June 2010

LinkedIn - beware of unofficial references

More and more people are soliciting their contacts (which may include colleagues and co-workers)for positive comments about themselves, presumably for use in future job searches. In a recent example, a client told us that several senior employees had been asked for, and had subsequently posted, positive references about another employee whilst the terms of his compromise agreement were still being negotiated.

This can have a couple of negative consequences:

1. Even though it may not be perceived to be a formal reference, where an employee provides comments about an ex¬ employee on LinkedIn or on any other medium, this is not treated as just a personal comment by that individual. He or she is effectively giving a reference on behalf of the company. If that reference turns out to be misleading, the company could be subject to a misrepresentation claim.

2. Not a legal point but where the company is trying to conclude a negotiation with an ex employee, it could prejudice the negotiations if employees from the group are posting positive comments on the internet.

HR should be aware of these issues, an take appropriate measures, to protect the company.

Monday, 10 May 2010

Do recruiters look at online profiles and should online reputations matter?

___________________________________________________________

Current Article Are you paying attention to your online reputation? Employers are.

By anthony balderrama on May 6, 2010 in Career Advice, Featured, Job Search

http://www.theworkbuzz.com/career-advice/online-reputation/

Social media (Facebook, Twitter, blogs) and other user-generated-content sites (think of picture and video sharing sites) are not new. They certainly came of age in the past decade, but in Internet Land, a few years are equal to a few decades. Therefore, you’re not surprised that employers are looking online to see what information you’ve posted: networking profiles, blogs, posts on online forums, pictures and videos.

You might have heard of “digital dirt” in the job hunt, and this information is precisely what that term refers to. That picture of you drinking a little too much champagne on New Year’s Eve 2008? Yeah, that’s digital dirt.

Once upon a time employers used references to assess your ability to fit into their organizations. Because you’re on your best behavior during an interview, they had to hope you possessed the character and personality necessary for the job. Thanks to efficient search engines (and job seekers with lax privacy settings), employers can unearth a wealth of information about you. Hopefully this fact isn’t news to you. After all, we’ve warned you about this on the Work Buzz plenty of times. But if you are surprised, prepare yourself for what follows:

In the Microsoft survey “Online Reputation in a Connected World,” employers explained where they look for job seeker information during the hiring process. The answer: everywhere. The survey, which came to my attention via Lifehacker, puts to rest any doubts you might have had about the importance of your online image.

The survey finds that only 7 percent of U.S. consumers (aka job seekers) believe available online information about themselves affected their job search. Yet, 70 percent of recruiters and HR professionals have rejected a candidate for information they found online. These research efforts aren’t just the work of overeager hiring managers with too much free time. In the U.S., 75 percent of surveyed recruiters and professionals say their organizations have formal policies that require them to do online digging. Based on those figures, the concern seems to have changed from whether or not your online reputation will affect your job hunt to how it will affect your job hunt.

The survey goes on to discuss some other important factors you might not have considered:

90 percent of HR professionals and recruiters are concerned about the accuracy of the information they find online and they attempt to verify it before making a final decision. (In other words, you better hope anyone who shares your name isn’t a liability.)

86 percent of recruiters and HR professionals say that a positive online image can benefit the candidate.

48 percent of consumers think they have complete responsibility for their online reputation, and 46 percent think the responsibility is shared between the site and themselves. Yet, 62 percent of HR professionals and recruiters view the responsibility as entirely the job seekers’.

I strongly encourage you to read the full study to get a glimpse of what hiring managers, recruiters and their organizations are thinking. On a job search, the more information you have about potential employers, the better you can prepare yourself. Handling your online image doesn’t have to be an impossible task, but it does take attention and time. Entering your own name in a search engine is a good first step in discovering what your online image is. Once you see what information is out there—whether your own or that of someone else with the same name—you’ll find yourself thinking twice about your digital footprint.

Wednesday, 14 April 2010

Deception in Selection - CV lies

___________________________________________________

guardian.co.uk, Wednesday 24 June 2009 10.37

by Harriet Marsh

Nick is a teacher at an English language school in Tokyo. Nick is also deceiving his employers. On his arrival in Japan eight years ago he obtained what he expected to be a temporary job teaching English by claiming he had a degree from Oxford University. He backed up the claim with a false degree certificate obtained in Bangkok.

In reality Nick has one A level and no degree. He fabricated a university career because he felt that it would dramatically increase his chances of employment. He was right and Nick has no plans to return to the UK. Backed by his bogus qualification he is now, after eight years, the longest serving foreign teacher in his school.

Yet he admits it can be hard to live the lie. "Several years ago the school hand-picked me to accompany a group of students to Oxford on the basis that I knew the city well because I had spent three years studying there. In reality I had been there once for the weekend to visit some friends. Yet I had to maintain the charade: to come clean now would be unthinkable," he says.

Getting a job can be highly stressful and candidates feel pressure to enhance their achievements to present themselves in the most favourable light.

In their book Deception in Selection, Liz Walley and Mike Smith suggest that, in such circumstances, people are pushed to deception in the belief that "everyone else is doing it".

Certainly lying on CVs is on the increase. Surveys suggest as many as a quarter of job seekers deviate from the truth on their CV. The common distortions include bogus or exaggerated qualifications, changing the dates of employment to hide career gaps and exaggerating the pay received in a previous job.

Every job-hunter faces the challenge of presenting their qualifications and past experience with as positive a gloss as possible. So just where does harmless exaggeration end and outright deception begin? It is a difficult question to answer, just as it is hard to define what are company perks and what is simple theft.

While exaggeration is widespread and generally accepted, it is unwise to resort to outright lies. This is not merely moral advice, it is also expedient. Outright lies such as qualifications or invented jobs will work against you.

At best, the cost of lying to future employers is the embarrassment of being found out. At worst, it can cost you the job. Under the terms of the contract of employment, prospective employees are required to tell the truth.

A CV acts as a personal history form and if a job offer is made on the basis of information contained in a CV that the employer believes to be correct, then the employer is legally entitled to withdraw the job offer if they discover the CV contains false information.

Take the example of a young man recently employed by a major household goods manufacturing company, who discovered this the hard way.

He joined the company claiming his previous salary to be 25% higher than it actually was. Yet when the payroll system processed the tax details from his former employer the deceit was uncovered. Four hours after arriving at his desk he was marched from the building.

In Deception in Selection, Walley and Smith put forward the theory that job candidates often fabricate an element of their CV in the belief that it will only be a short-term measure. Yet, if not discovered early on, they find it hard to turn back the clock and escape their deception.

Tuesday, 23 March 2010

CV Liers can get prison time

_______________________________________________________

Suspended sentence for NHS manager who lied on his CV

Louisa Peacock 22 March 2010 16:18

A senior NHS manager who lied on his CV has been given a 12-month suspended prison sentence and told to carry out 200 hours of unpaid community work.

Hasan Tahsin, former head of estates and capital projects at Mid Essex Hospital Services NHS Trust, made fraudulent claims about his qualifications and memberships of professional bodies when he applied to several posts at five NHS trusts between March 2004 and March 2009. The skills required, including project management and estates management, were essential for each position.

Tahsin was discovered following an audit of senior managers' qualifications for the trust. He was arrested and interviewed by the NHS Counter-Fraud Service in May 2009, when he admitted he had lied to get the jobs - which fraudulently earned him £245,246 during five years.

Tahsin, 54, of Chadwell Heath in Romford, Essex, held responsible positions within the NHS dating back to 1990.

Investigating officer Alan McGill, of the NHS Counter-Fraud Service, said: "It is regrettable that Tahsin managed to secure senior management posts within the NHS for so long. Such deceptions are the exception and the vast majority of NHS staff are of high integrity.

"This case demonstrates that when suspicions of fraud are brought to the attention of the NHS Counter-Fraud Service, we will thoroughly investigate and, where fraud is found, will seek to prosecute."

The case follows that of senior NHS HR manager Kerrie Devine, of Lympstone, Devon, who lied on her CV by claiming she held a degree in HR management and was part way through a CIPD course. Devine was given a six-month suspended prison sentence and ordered to pay £9,600 in compensation.

Monday, 1 March 2010

FSA consults on referencing for Approved Persons

This paper is of particular interest to those of you involved in recruiting employees for controlled functions and in overseeing, developing and administering processes for complying with the FSA’s approved persons regime.

You can send your comment to the FSA by 28 April 2010. The FSA will finalise the proposals and aim to publish the final rules in a policy statement during the third quarter of 2010.

You can read the whole paper at: http://www.fsa.gov.uk/pubs/cp/cp10_03.pdf

Below are some highlights on what is proposed:

Clarification of our position on ‘compromise agreements’

3.20 We propose to amend the Supervision manual (SUP 10) to give further guidance on our rules that require firms to disclose information where an individual is suspected of doing something that may result in dismissal, or resigns while under investigation by the firm, or there are issues that may affect our assessment of the individual’s fitness and propriety to be able to perform a controlled function.

3.21 Occasionally, firms or candidates will cite confidentiality clauses in a ‘compromise agreement’ as a reason for not providing relevant information regarding the circumstances of an employee’s departure from their previous employment.

3.22 In our view, the requirements of our principles and rules override any duty of confidentiality entered into between a firm and its employee. We therefore propose to add guidance to our rules to clarify this.

4.6 The onus is on the firm to provide sufficient information in the application process to satisfy us that they have fully assessed the candidate and can confirm that they are fit and proper under section 61 of FSMA. Failure to do so can represent for us an important indicator of the quality of the firm’s systems and controls for recruitment, and persistent failures to provide robust information in support of applications may result in us taking further supervisory action.

4.7 The type of information that will help us to make our approval decision includes details of the:

• responsibilities that the role involves and the competences that it requires;

• recruitment, referencing, interview and appointment processes;

• due diligence undertaken by the firm to ensure the candidate is fit and proper; and

• firm’s rationale for concluding that the candidate is fit and proper to perform the role in question, including an assessment of the competence of the candidate and information about any action to be taken post-appointment to address any developmental gaps or training needs that have been identified.

It may also include supporting documentation or reports from third parties, such as head-hunter or other similar reports.

4.8 In 2008 we made changes to Section 6 of the application form (Form A), which now asks firms to provide details of the due diligence undertaken on the candidate. During 2010, we intend to make further changes to this section of the application form to remind firms to supply the above information where appropriate.

4.9 Where firms can demonstrate they have undertaken appropriate due diligence this may remove the need for us to conduct an interview.

4.10 Firms will also note, in relation to ‘referencing’:

• our proposal on ‘compromise agreements’ outlined in paragraphs 3.20 to 3.22; and

• our intention to provide guidance to clarify that the requirement upon firms to provide information on ex-employees who performed controlled functions for them overrides any confidentiality provision they may have agreed with their ex-employee.

4.12 To further assist firms in managing the time pressures that may arise when submitting applications that may involve an interview, firms can submit applications before they have fully completed their own due diligence checks (e.g. Criminal Records Bureau and/or credit checks outstanding). In these instances, firms must use Section 6 of the application form to detail the due diligence checks they have already performed on the candidate before submission, and those that are outstanding (which will be completed by the firm before appointment). This will allow us to take the process forward, but we will expect firms to provide supplementary information about the outcomes of their final checks before final approval can be granted.

10.13.

7A

G The obligations to supply information to the FSA under SUP 10.13.7 R

apply notwithstanding any agreement or any other arrangements entered into

by a firm and an employee upon termination of the employee’s employment.

A firm should not enter into any such arrangements or agreements that could

conflict with its obligations under this section. Failing to disclose relevant

information to the FSA may be a criminal offence under section 398 of the

Act.

Credit Rating Myths

_____________________________________________

1. People who have lived in your home before you do not affect your credit rating. The only people that affect your rating are those you have a financial connection with – for example, a joint account or joint mortgage.

2. Registering to vote will improve your credit rating.

3. Checking your credit report will not harm your rating.

4. There is no “credit blacklist”. Many consumers mistakenly believe that lenders hold a database of blacklisted people that will never again be given credit. This is untrue.

5. Paying a mobile phone bill late will damage your credit rating. Always pay all bills on time to keep your record squeaky clean.

6. All applications for credit made in the last 12 months appear on your report – although the report does not detail whether or not the applications were successful. If you have made numerous applications recently, this will damage your record.

7. The size of your credit limit affects your rating. If you have large amounts of credit already available, such as an overdraft and credit cards, you are less likely to be given new credit.

8. Getting married or divorced does not affect your credit record. The record only notes financial connections – so if you are divorced but still have a joint account, your credit rating will still be linked to your ex-partner’s.

9. If a credit account is in default, this will stay on your credit record for six years.

10. If you do remove your name from a joint account, you should still tell a credit reference agency you want to "disassociate" yourself from that person.

Source: Experian

Monday, 22 February 2010

2009 Fraud Trends - CIFAS publishes its report for last year

____________________________________________________

Fraud continues to demonstrate impact of the recession

The analysis of fraud trends during 2009 by CIFAS - The UK's Fraud Prevention Service - reveals a 9% increase in the overall level of fraud, when compared with the previous year. This rise has been driven by some particular factors, most notably:

the unwelcome return of identity fraud which has led to a 31% escalation in the numbers of victims of fraud

a 55% increase in false insurance claims and a change in the nature of them as the effects of the recession intensify

the relentless rise in facility takeover and misuse of facility frauds.

(Numerical tables are included in the Notes for Editors below).

32% surge in identity fraud

CIFAS commented in October 2009 (in The Anonymous Attacker) on the reappearance of identity fraud (the use of a stolen or false identity to obtain goods or services by deception). This increase has continued; up 32% in 2009 from the level recorded in 2008. This rise has a direct link to the recession. Fraudsters have seen the reduction in the overall amount of lending taking place during 2009, discouraging many from attempting to commit application fraud (e.g. the use of lies and forged documents in an attempt to obtain products or services). This has led to a 25% reduction in application fraud but has meant that they have returned to stealing the identities of others in order to gain products and services.

Protective Registration (a service provided by CIFAS to help protect individuals at heightened risk of identity fraud) increased by 241% year on year. This is attributable both to a developing awareness among individuals of the threat of identity fraud and how it is perpetrated, and to the growing use of the service by organisations to protect the identities of those whose details have been put at risk as a result of a data breach.

Over 25,000 more victims in 2009

With over 85,000 victims of impersonation, and 24,000 victims of takeover (whose accounts have been hijacked by fraudsters) recorded in 2009 (increases of 35% and 16% respectively on 2008 and an overall increase in victims of 31%), the very real impact of fraud is underlined. Fraud victims can be preyed upon by organised criminals, faceless fraudsters and sometimes even by those close to them. Victims commonly describe feelings of helplessness, vulnerability and not knowing who to trust. This is in addition to the financial impact and time taken to rectify the damage.

CIFAS Communications Manager, Richard Hurley, comments: "The financial cost of fraud is bad enough, but the emotional and psychological effects for the victim must never be underestimated. Fraudsters are adapting their approach in an attempt to ensure that their profits do not suffer during the recession, with absolutely no thought for the profoundly damaging impact this has on their victims. The role played by online, organised, criminals trading in people's identity details has been frequently reported in recent years, and it is depressing to think that the numbers of victims of fraud demonstrates just how little these criminals care."

Rise in insurance fraud shows increase in premeditated 'accidents'

While insurance fraud has long been difficult to prove (for instance, adding to claims for stolen cars or laptops other items such as mp3 players, mobile phones, cameras and wallets), the 55% increase in cases filed by CIFAS Members during 2009 reveals a trend towards claimants being even more dishonest. The 55% increase in fraudulent claims is driven more by a surge in claims for staged or completely fictitious events than inflated claims for damage and losses actually incurred.

On 1 March 2010, CIFAS will publish its report Fraudscape 2010: Depicting the UK's Fraud Landscape. This examination of fraud trends will provide a more detailed look at what lies behind the increase in false insurance claims as well as in all other types of fraud identified by CIFAS Members throughout 2009.

Facility takeover fraud and misuse of facility continue to be double trouble

Previous figures from CIFAS have confirmed the intensification during the past two years of facility takeover frauds (also known as 'account takeover' where a fraudster hijacks an individual's account in order to 'take over' and control it) and misuse of facility frauds (where the fraudster uses an account, policy or other facility for a fraudulent purpose such as receiving fraudulent payments into a bank account, or evading payments on credit card or loan accounts).

In 2009, facility takeover fraud rose by 16% from 2008. This means an increase of over 250% during the past 24 months. A significant contributory factor to this trend is the prevalence of 'phishing' emails (sent by fraudsters to look as though they come from a bank or credit card company, for example, asking for personal details which are then used to plunder the victim's account).

Similarly, misuse of facility has risen by 28% in 2009 and by 115% during the last two years.

The link between these types of fraud runs deep, with fraudsters frequently using both methods: for example, taking over an account to withdraw funds and then using another account to receive these bogus 'transactions'. Richard Hurley explains: "Whether it is an organised criminal obtaining your account numbers online, or someone in dire financial straits misusing their cheque-book account, the net result is still fraud: fraud that costs businesses, the public sector, and ultimately all of us, millions of pounds each year."

Comment from the CIFAS Chief Executive

Peter Hurst, CIFAS Chief Executive, comments: "It is well-known that a rise in fraud goes hand in hand with a recession. The trends identified by CIFAS Members during 2009, however, demonstrate that it is not just a few thousand extra people turning to crime to make ends meet. It is a whole criminal element changing its behaviour. Fraudsters adapt their methods in response to changes in the economy, finding and exploiting any area of weakness.

"All organisations must acknowledge this by arming themselves against the fraudsters. As these figures demonstrate, fraud is very much a present danger - no matter what the circumstances. Working together, sharing data on proven frauds and sharing best practice are the only ways that fraud can be prevented - and it is not only the pragmatic thing to do, but also the responsible thing to do in times of continued economic strife."

Thursday, 28 January 2010

SIF's approval process continues to occupy the FSA's agenda

The FSA has reserved the right to interview (at their offices), any individual who will be occupying such a function. If they find that the applicant does not have the abilities and competencies required, they can (and have) reject the appointment. So far 25 potential appointments have been rejected and the interviews are gathering speed.

Firms are well advised, to make sure that during the interviewing and vetting process, documentation to prove competency is obtained and retained. Previous experience, qualifications and personal references can all be used for this purpose.

Below, is the official press release and link to the full consultation:

_________________________________________________________________________

FSA outlines latest steps to address corporate governance at firms

The Financial Services Authority (FSA) has today issued a Consultation Paper (CP) on effective governance standards within firms.

As part of its supervisory enhancement programme, the FSA places greater emphasis on the role of senior management at firms. Since adopting this approach in 2008, the FSA has carried out 332 significant influence functions (SIF) interviews, with 25 candidates withdrawing from the process.

The FSA has issued a number of publications in this area, including a ‘Dear CEO’ letter in October 2009, which clarified its approach to approving and supervising persons performing SIFs. This CP explains this more intensive process in greater detail, but also makes clear that the intention is not to deter strong candidates from pursuing senior roles in firms.

Graeme Ashley-Fenn, FSA’s director of permissions, decisions and reporting, said:

“Our more intrusive approach continues to place a great deal of emphasis on governance and therefore the senior management at firms. This starts with a firm’s own due diligence. Our experience shows that once a firm gets its corporate governance right; with a strong and effective board, everything else flows from that.”

Walker Review

The proposals implement the FSA-specific recommendations in Sir David Walker’s review of corporate governance published in November last year. Where appropriate, listed banks and insurers are now strongly encouraged to establish board risk committees and appoint top executives as chief risk officers.

Sally Dewar, managing director of the FSA’s risk business unit, said:

“We have been very clear about our more intensive supervisory approach of firms and individuals, and our renewed focus on the quality of governance. We were fully supportive of Sir David's recommendations and this CP sets out how we intend to deliver them through our ongoing supervisory work and authorisation processes.”

Enhancing the SIF regime

Underpinning this intrusive approach, today’s paper consults on extending the scope of the SIF regime and introduces a new, more detailed framework of controlled functions. These will make clearer the exact role an individual is performing within a firm and increases the FSA’s ability to vet and track individuals as they move role. The FSA is also extending the regime to capture more individuals from parent companies who exert significant influence upon a UK regulated firm.

The consultation period closes on 28 April 2010. The FSA hopes to have final rules in place during the third quarter of 2010.

NOTES FOR EDITORS

1. The Consultation Paper can be found on the FSA website at: http://www.fsa.gov.uk/pubs/cp/cp10_03.pdf

Thursday, 14 January 2010

Checking Business Involvements and approved persons

____________________________________________

FSA/PN/006/2010

14 January 2010

FSA bans insurance broker for failing in his duties as a director

The Financial Services Authority (FSA) has banned Stephen Allen, a director of insurance broker, Fabien Risk Services Ltd, for failing in his duties as a director of a regulated firm.

Allen’s ban means he is prohibited from holding any management role in the UK financial services industry and any role that requires FSA approval.

The action follows an investigation by the FSA that also resulted in the banning in 2007 of Allen’s co-director Shane Garvey and Fabien office manager Lee Goddard.

In late 2005 when Fabien was placed in creditors’ voluntary liquidation, the firm had suffered £700,000 in losses, of which £470,000 was owed to insurers, brokers and underwriters.

An FSA investigation revealed that Garvey authorised the withdrawal of client funds and Goddard complied with instructions to use the money to keep Fabien trading without Allen’s knowledge. The FSA therefore found that Garvey and Goddard lacked integrity.

Allen accepted that his lack of knowledge of Fabien’s bank accounts was a neglect of his duties and that he had failed in his duty as a director. As a result, it was concluded that, although Allen did not lack honesty or integrity, he lacked the competence to run a regulated firm.

Margaret Cole, director of enforcement and financial crime at the FSA, said:

“As a director there is an expectation that you are competent enough to look after client money; Allen did not fulfil this role as he failed to exercise closer scrutiny over Fabien’s accounting processes.

“We have clear rules about how a regulated firm should be run; Allen, Goddard, and Garvey failed to adhere to these rules and therefore showed themselves to be neither fit nor proper. Because of this, and the inherent risk they pose to consumers, we have taken tough action against all three: Garvey has been banned from working in the regulated financial services industry, Goddard from holding significant influence roles and Allen from any management role in the UK financial services industry and any role requiring FSA approval.”

Both Allen and Garvey held the Controlled Function 1 (director) position at Fabien; Goddard was not an approved person and his chief role was as accounts manager.

Tuesday, 22 December 2009

Senior Public Sector Worker spared prison over lies told on CV

A senior NHS Human Resources manager who exaggerated her qualifications has been given a six-month suspended prison sentence and ordered to pay nearly £10,000 compensation.

The individual in question was found to have made the claims when her Trust merged with another in 2006: staff were asked to submit expressions of interests for new posts, and she made a series of misrepresentations in an attempt to obtain alternative employment.

She last week pleaded guilty to six counts of fraud by false representation at Exeter Crown Court. As well as the fine, she must also carry out 150 hours of unpaid community work. The conviction follows an investigation by the NHS Counter Fraud Service.

Alexandra Kelly is the Managing Director of city pre-employment firm, Powerchex. Kelly has considerable experience of similar situations and is well aware of the repercussions that CV embellishment can have on both in the individual and the company affected.

“Jobseekers should be aware of the perils of being caught lying on their CV or any other documentation used in order to gain employment. More and more employers are outsourcing their pre-employment screening to professional firms with the tools and experience to uncover CV embellishments or even outright fabrications. While this particular situation is unusual in its severity, most employers will look to terminate if they get wind that you have misrepresented yourself at any stage of the hiring process.”

Perhaps even more saliently, employers need to be aware of the reputational damage CV embellishment can cause to their company, especially if information comes to light after the individual has already started their employment. “Sadly it is no longer enough for firms to simply ask their employees to sign a declaration stating that any information supplied about themselves is true,” continues Kelly. “Like the above situation, such incidences can gain bring considerable negative exposure, with associated financial and reputational consequences. Firms must make clear to their potential employees that the information they provide during the recruitment process will be subject to relevant checks, and that employment is conditional upon verification of all information supplied. Unfortunately, the risks are now too great not to err on the side of caution.”

Friday, 4 December 2009

Criminal checks, the FSA, and Approved Persons - Do you have it right?

_____________________________________________________________________

Powerchex Warns of the Risk of Insufficient Background Checking

after The FSA takes Action

Insurance Brokerage Firm penalised for failing to conduct basic checks

London, 3rd December 2009. The Financial Services Authority has banned two insurance

brokers for colluding to conceal a criminal conviction. The FSA also cancelled permission for an Insurance Brokerage firm to carry on regulated activities.

Margaret Cole, the FSA’s director of enforcement and financial crime, said:

“We have made examples of [these parties] to send a warning to firms and

individuals: do not lie to the FSA. This case, and others that are due to follow, serve as a clear signal about the consequences of giving anything less than full and frank disclosure of material information to the FSA.”1

Alexandra Kelly, a director of pre‐employment screening firm at Powerchex, believes that the Insurance brokerage firm engineered its own downfall; “The FSA is explicit that it expects firms to conduct checks on individuals applying to work in controlled functions. This unsurprisingly includes criminal record checks as standard. Had the firm in question conducted such checks, the FSA would have had no cause to take such drastic action.”

In this particular case, one of the brothers had applied for a controlled function having recently been convicted of conspiracy to defraud. On his FSA application, he signed a declaration that he had no previous criminal convictions, and was not the subject of any current criminal proceedings. His brother helped conceal the conviction from the FSA, despite occupying a regulated role himself and knowing the risks this involved.

“Sadly it is no longer enough for firms to simply ask their employees to sign a declaration stating that they do not have any criminal convictions,” continues Kelly. “Especially for those individuals applying for controlled functions, it is critically important that relevant identity,credit and criminal record checks are conducted as an absolute minimum. In this particular case, failure to do so has resulted in the cancellation of permission from the FSA to carry out regulated activities. I think this ruling will cause a lot of firms to sit up and take notice.”

Friday, 27 November 2009

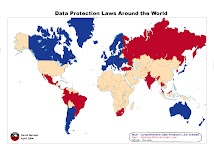

Data Security and Data Privacy Laws are not the same worldwide

________________________________________________________

04 November 2009

Article by Christine Carron and Martha A. Healey

The protection of personal information is an important issue as business operations become increasingly global in nature. Coupled with the Internet enabling personal data to be distributed almost instantaneously across the globe, privacy has quickly become a critical international concern that can often be confusing due to a global patchwork of laws and regulations. A US organization conducting business in multiple foreign jurisdictions must be aware privacy laws are not equal everywhere. Unless the most restrictive regulatory regime is adopted, country by country procedures may be necessary.

CANADA

Canada While Canada is often assumed to be similar to the US with respect to business practices, privacy regulation is another matter. The Canadian approach to confidentiality and the transfer of personal information is much more in line with the European model than that of the US. (It was, in fact, designed to be this way.) The federal personal information protection regime in the Canadian private sector is mainly governed by the Personal Information Protection and Electronic Documents Act (PIPEDA), which became effective in 2004 and extends privacy protection to all personal data collected by companies on individuals in the course of commercial activity, except employees other than those of a federal undertaking. It follows that, in most cases, personal information of employees is regulated by applicable provincial law. Only Alberta, British Columbia and Quebec have enacted privacy legislation. That provincial legislation, however, is substantially similar to PIPEDA. Ontario has enacted privacy legislation but only with regard to personal health information.

It is important to note that when transferring personal information outside of Canada, the transferring organization has an obligation to provide a comparable level of protection meaning the level of protection provided by the third party must be comparable to the level of protection afforded the personal information within Canada. The Privacy Commissioner of Canada has ruled that, not withstanding the USA PATRIOT Act, personal information transferred to the US can benefit from protection similar to that enjoyed in Canada. She added, however, that notice must be given to individuals alerting them to the fact their information will be stored in the US where it becomes subject to the USA PATRIOT Act.

Another recent, high-profile example involved Facebook, the hugely popular social networking site. On July 16, 2009, Canada's Privacy Commissioner ruled that Facebook was in breach of Canadian privacy laws on several fronts, particularly with respect to the circumstances surrounding consent to the disclosure of personal information to third party application developers and the retention of personal information of users who had closed their accounts. Initially, Facebook resisted complete compliance with the Privacy Commissioner's recommendations. However, given the Commissioner's ability to submit the matter to the courts, Facebook ultimately proposed solutions satisfying Canadian privacy laws.

As Facebook learned, a "global" approach to privacy works only where the privacy policy is written so as to comply with all jurisdictions in which an organization does business. Facebook recently indicated that it plans to amend worldwide practices to implement Canadian privacy requirements globally.

Another recent example illustrating this is the case of Abika.com, a US-based online data broker. On July 31, 2009, after a nearly five-year investigation, the Privacy Commissioner ruled Abika had violated Canadian privacy laws by disclosing the personal information of Canadians without their knowledge or consent to third parties.

EUROPE

The EU has developed a very sophisticated personal information protection regime with stringent standards that has influenced the adoption of privacy laws throughout the world. Directive 95/46 sets out the general principles with regard to the processing of personal information, which are now implemented in the national law of every EU member state. The underlying principles of Directive 95/46 were largely based on those of international bodies, like the OECD's Guidelines on the Protection of Privacy and Transborder Flows of Personal Data.

The EU's privacy legislation closely resembles that of Canada, however, how this legislation is interpreted can lead to some surprising differences, particularly with respect to the validity of consent given to the collection, use and disclosure of personal information.

Consent is in the lynchpin of Canadian privacy legislation. In the EU Directive, persons from or about whom data is collected must unambiguously grant their consent before such data is collected, after having been informed about the purpose(s) for which the data will be used. The interpretation of the validity of consent may impact a US business processing personal information of European customers or employees. For example, relying on employee consent to the collection of certain personal information can prove to be difficult since some European countries question whether that consent is "freely given" given the desire to be employed or to keep employment.

Another key tenet of the EU privacy directive is that it prohibits the transfer of personal information to non-EU countries, including the US, unless those countries provide adequate protection for the information. While the US has not been, officially, deemed to provide adequate protection, the two jurisdictions are negotiating so as to facilitate normal business relations. The Safe Harbor Agreement allows US companies to avoid sanctions imposed by the EU if they voluntarily embrace a somewhat less stringent version of the EU privacy directive.

THE REST OF THE WORLD

Once you move out of Canada and Europe, all bets are off with respect to the extent that privacy legislation exists or is enforced. In many jurisdictions there is no one law or regulatory framework governing privacy. Instead, laws or regulations relating to privacy are often found as a sub-set of sector-specific or constitutional laws.

Asia-Pacific: Regions that have recently adopted privacy legislation include Australia, Hong Kong, Japan, Macao, New Zealand, South Korea and Taiwan. China, Malaysia, the Philippines and Thailand are currently in the process of drafting legislation. Indonesia, Singapore, Vanuatu and Vietnam only have privacy provisions in sector-specific laws. Still, many Asia-Pacific regions do not have privacy legislation, including Brunei, Cambodia, Laos, Myanmar and the majority of the small Pacific island countries.

India: India does not have comprehensive privacy laws in place. The right of privacy is not expressly recognized in the Constitution of India, although the Supreme Court of India has implied it from article 21 of the Constitution, which states that, "No person shall be deprived of his life or personal liberty except according to procedure established by law." However, this right is not absolute and can be restricted under procedures established by law or if a superior interest commands it. Laws that do exist relate to the privacy of data held by public financial bodies (e.g. banks) and electronic data (the Information Technology Act of 2000). India is moving to bring their privacy laws in step with Europe and other jurisdictions. The Personal Data Protection Bill, based primarily on foreign privacy legislations, was introduced in 2006 and is currently still pending.

Latin America: Currently, very few Latin American regions have any privacy legislation and there is no cohesive framework for the region. However, the importance of a harmonized privacy legal framework for the region has been recognized and many countries in this region are currently working on developing it.

CONCLUSION

Although efforts are underway in many regions to harmonize legislation, privacy laws around the world still differ in many respects. Outside of Canada and Europe, privacy legislation is either non-existent or a patchwork of sector-specific laws and regulations. US organizations conducting business in these regions should use the most stringent legislation as the lowest common denominator in order to establish an effective privacy policy.

About Ogilvy Renault

Ogilvy Renault LLP is a full-service law firm with close to 450 lawyers and patent and trade-mark agents practicing in the areas of business, litigation, intellectual property, and employment and labour. Ogilvy Renault has offices in Montréal, Ottawa, Québec, Toronto, and London (England), and serves some of the largest and most successful corporations in Canada and in more than 120 countries worldwide. Find out more at www.ogilvyrenault.com.

Friday, 20 November 2009

The FSA presents it's agenda for fighting economic crime

"We are the gatekeeper of the UK financial system. Firms or individuals wishing to operate in the UK must meet our 'fit and proper' standard. Those who don't, stand to be rejected during our authorisation, approval or change of control processes. There are numerous aspects to fitness and properness – competence, integrity and the ability to establish the right culture and tone at the top are important features.

A murky past, a reputation for unscrupulous business methods or sailing close to the wind will also call fitness and properness into question. Applications from countries where personal histories are obscure or controverted, or corruption is endemic in business life, add to the challenge.

We address these challenges by building stronger links with overseas law enforcement and regulatory agencies, by devoting more people and resources to the cases that call for heightened due diligence and, above all, as you would expect from an intrusive regulator, by a sceptical, questioning approach that does not shy away from making decisions that will be contested. In this we are aided by the fact that the burden of proof is on the applicant to satisfy us of their integrity. That puts us in a strong legal position to take robust decisions, and we have been doing so.

People seeking to bypass the FSA as gatekeeper can expect little sympathy. In September this year we brought our first prosecution against an individual for acquiring a controlling interest in a regulated firm without giving the FSA prior notice and for making false and misleading statements – and we obtained a conviction. A second prosecution is under way.

But we don’t or shouldn’t perform the gatekeeper function in isolation – we do expect authorised firms to work with us in the fight against financial crime and to assist us in keeping undesirable companies and individuals away from UK authorised firms and their customers."

On data security she stated:

"And data security is another area where we can, and will, use enforcement action to support the work of our supervisors. We expect firms to consider how their actions or failures leave others open to the threat of fraud. We continue to learn of data security lapses that put customers’ personal information at risk. This summer’s enforcement action against three units of HSBC saw substantial fines paid for weak controls over the security of customer data. And we will follow up with further enforcement cases to demonstrate the importance of this subject."

Friday, 13 November 2009

Employee fraud; should we be re-checking current employees?

This is a case of a trusted, current employee who betrayed their employer and caused them untold grief, loss of reputation and financial penalties. Andrew Cumming, a former client adviser at the London branch of UBS AG (UBS), was fined and banned by the FSA for his role in the activities that led to the firm receiving an £8 million fine earlier this month for systems and controls failings.

According to the FSA's press release "Cumming has been fined £35,000 and prohibited from performing any regulated function for a minimum period of five years on the grounds that he is not fit and proper.

Paperwork signed by Cumming, who worked in UBS’ international wealth management business, helped to document false loans which were used to conceal losses arising from unauthorised trading.

Customers whose funds were used were told they were providing loans to other UBS customers with promises of high rates of interest. To make these ‘loans’ appear official, documents were produced using UBS headed paper and sent to customers stating that the ‘loans’ were guaranteed by the firm.

The FSA’s investigation concluded that Cumming signed these documents on seven occasions between October 2005 and October 2007 having been asked by a senior colleague to do so, even though he knew the ‘loans’ were not authorised by UBS.

By late 2007, Cumming was fully aware that the ‘loans’ were being used to conceal losses which had arisen as a result of unauthorised transactions but he failed to escalate this knowledge. Instead, Cumming signed a further ‘loan’ and allowed the ruse to continue.

Margaret Cole, FSA director of enforcement and financial crime, said:

“Cumming deliberately misled UBS and its customers. Although he did not stand to make a personal gain, his complicity allowed a colleague to continue making unauthorised trades, while the losses continued to mount up.

“We are committed to deterring behaviour of this kind by banning and fining anyone found to have committed such misconduct.”

In setting the financial penalty, the FSA took into account the fact that Cumming did not initiate the circumstances which led to his misconduct, nor did he conduct any of the unauthorised transactions. Because he agreed to settle at an early stage of the FSA’s investigation he qualified for a 30% discount in respect of his financial penalty. Cumming also proved to the FSA that he is in serious financial hardship, entitling him to a further discount.

If it wasn’t for the settlement discount and Cumming’s hardship, the FSA would have imposed a financial penalty of £100,000.

Cumming worked at UBS’ London branch from 1999 until March 2008, when he was dismissed for gross misconduct relating to this case.

Earlier this month, the FSA fined UBS £8 million for systems and controls failures that allowed employees to carry out unauthorised transactions with customer money. UBS has since repaid the affected customers in excess of US$42 million by way of redress. "

The issue for compliance and HR departments is to decide whether they should be re-checking current employees, what they should be re-checking and how often. Our view is that annual credit checks, especially for approved persons would help alert the employer if the employee was facing financial pro(a threat to their fitness and propriety for a role). Annual criminal checks should be done more selectively, since a court case would not easily go undetected by the employer.

Obviously, no decision should be taken without input from the risk management department, but as a minimum, firms should be asking employees to fill out and sign an annual declaration stating that they have not gotten any criminal convictions or judgments since their last declaration.

Tuesday, 10 November 2009

Right to Work - What to check and how?

____________________________________________________________

Companies that supply staff should be wary of the reputation risk to their clients of using staff with no right to work in the UK.

Kenneth Hanslip, head of professional standards at NSL Services, a company that provides traffic wardens (civil enforcement officers) to many local authorities, said that whenever a traffic warden was discovered to be working in the UK illegally there were stories in the press about “terrorist or Taliban traffic wardens”. This would lead to calls from concerned clients.

Other risks of employing illegal workers are a civil penalty of £10,000 per person employed as well as the risk of those individuals carrying out fraud and other criminal activity within the company, said Hanslip.

In one case, he said NSL (formerly part of National Car Parks) lost £43,000 when an accounts clerk committed fraud. “We still do not know who that accounts clerk was, because the person disappeared,” Hanslip told HR and recruitment professionals at a Symposium Events forum on Employing and Vetting Non-UK Nationals in London.

Hanslip said that around 30% of the company’s staff are foreign nationals from outside the European Economic Area (EEA), with many coming from West Africa, but also Afghanistan and Iraq.

Hanslip recommended a number of actions that recruiters could take to reduce the risk of taking on staff without a legal right to work in the UK:

- close liaison with local UK Border Agency immigration teams

- regular National Insurance number payroll sweeps to identify discrepancies

- avoid temporary National Insurance numbers

- if in doubt about the authenticity of a document, seek assistance from document validation services at the UK Border Agency

- don’t take documents at face value - always speak to the person face-to-face

- don’t rely on photocopies of documents provided by the applicant, but check the original and then photocopy it yourself

- don’t assume that those with no right to work in the UK won’t target your company, or industry. People often pick out unsuspecting employers and industries to build up a work history that they can then use to get work elsewhere

Powerchex Wins Innovation Award Second Year in a Row

________________________________________________________

In the midst of the recession, Powerchex innovates and wins award at the Thames Gateway Business Awards

Powerchex, the leading pre-employment screening firm for financial services, has again won recognition at the prestigious Thames Gateway Business Awards.

This year, Powerchex was praised in the Innovation Category for its new service ‘Know Your Supplier’ (KYS). Judges were looking for businesses that could demonstrate that they had successfully introduced a new idea, technique or practice that had improved their business, how the idea was implemented and how it had impacted upon the business.

The glittering awards ceremony took place at the Troxy on Friday evening with more than 700 people in attendance. Judges paid tribute to Powerchex, recognising the bravery and forward-thinking of an SME prepared to innovate in a recession.

“I am absolutely ecstatic that our achievement has been recognised on such a scale,” stated Alexandra Kelly, Managing Director of Powerchex. “Not only have we shown that we are prepared to innovate and look at something completely new, but also have the confidence to put resources behind the project at such a difficult time for many small businesses.”

This is the second year running that Powerchex has been successful in the Innovation Category of the Thames Gateway Awards. Last year, Powerchex won praise for its pioneering staff training and development programme, which lowered costs by reducing staff turnover and increasing the output per person.

“It is extremely important to invest in your workforce, even in times of economic difficulty,” continues Kelly. “While it can be easy to concentrate only on the front-line of your business, keeping staff motivated and your cost-per-unit as low as possible maximises your chances of not just surviving, but actually growing your market share as markets recover.”

Enzo Testa, Executive Managing Director of Archant London commented; “We are proud to do all we can to support, encourage and promote businesses within the many local areas we cover. The rich mix of successful businesses across The Thames Gateway region make our communities, places we can be proud of. To this end, we are pleased to have organised this event.”

Wednesday, 14 October 2009

FSA outlines its approval and interview process for significant influence functions

________________________________________________

The Financial Services Authority (FSA) has written to the CEOs of 5,000 regulated firms to reinforce how its intensive regulatory approach applies to approving and supervising senior personnel performing significant influence functions (SIFs).

The letter reminds CEOs that the responsibility to assess whether a candidate is fit and proper to carry out a role rests with the firm and that firms should, therefore, have robust recruitment, referencing and due diligence processes in place.

As part of the SIF approval regime, the FSA has said it will undertake close vetting of appointments and will expect to interview candidates applying for SIF roles. Therefore, firms are being encouraged to engage with the FSA early in the recruitment process and for major firms, this should be at the point of drawing up a shortlist rather than waiting until the preferred candidate stage.

Firms are also urged to provide sufficient information with their applications (including supporting documents – for example head-hunter reports) and the rationale they have used to conclude that the candidate is fit to proper to perform the role. Applications must be made in a timely manner and any failure to engage promptly with the FSA may impede a firm’s plans to publicly announce a new appointment.

The enhanced SIF regime is one of the FSA’s responses to the financial crisis, which exposed governance and risk management shortcomings across numerous firms in roles such as chair, CEO, and finance or risk director. In the 12 months since October 2008 the FSA has conducted 172 SIF interviews, resulting in 18 candidates withdrawing their applications which shows there is considerable scope for some firms to be more robust in their own recruitment processes.

Graeme Ashley-Fenn, FSA director of permissions, decisions and reporting, said:

“It is crucial, that at a time when effective governance has never been more important, candidates have the right levels of competence and capability to perform these senior roles and that they are fully aware of their responsibilities.

“The onus is on firms to ensure candidates applying for influential positions are fit and proper to perform the role. Our individually tailored approval interviews will help us assess whether the individual has the right experience and understanding but also whether they will enhance the overall management strength and insight of the firm.”

NOTES FOR EDITORS

The FSA now interviews all candidates for SIF positions and in August 2009, extended the scope to include people employed by an unregulated parent undertaking or holding company, whose decisions or actions are regularly taken into account by the governing body of a regulated firm and to all proprietary traders who are not senior managers but who are likely to exert significant influence on a firm. These changes came into effect on 6 August 2009, with a transitional period of six months.

Wednesday, 7 October 2009

Powerchex warn that temps require the same level of pre-employment screening as permanent employees

____________________________________________________________

A convicted child sex offender was able to obtain employment in a nursery after staff failed to carry out the required pre-employment screening checks.

Andrew Smith was employed in the kitchen of Norwood Manor Day Nursery through employment agency Reed despite his name appearing on the sex offender’s register after he was caught sending a string of perverted internet messages and webcam footage of him performing a solo sex act to someone he thought was a 13-year-old girl, but was in fact an undercover police officer.

Smith subsequently served 6 months of a 12 month jail sentence and was placed on the sex offenders register for 10 years. The Criminal Records check that is required for those working in nurseries would have revealed this but staff failed to comply.

Alexandra Kelly, a Director at Powerchex, one of the leading pre-employment screening providers, believes that Smith being a temporary employee is no excuse for a low level of vetting, “We advise our clients to determine the level of vetting required using a risk based approach. Temporary workers pose the same, if not a bigger risk to the company than permanent employees. With temps there is an emphasis on the speed of vetting but companies should work closely with their provider of pre-employment screening to ensure that this need does not prevent proper due diligence taking place.”

Thursday, 1 October 2009

The Truth Behind Foreign Identity Documents

_____________________________________________________

Challenged when checking foreign passports and ID cards?

Here’s why ...

The number of ID documents currently in circulation is staggering. Every year, 208 countries issue countless documents, ranging from passports, ID cards and driving licences to visas and work permits. What’s more, 150 new document types join the existing pool on an annual basis.

Given the complexity and sheer volume of documents in issue, the authentication of ID documents presents HR departments with a considerable challenge. Indeed, many HR professionals feel that a document’s authenticity can only be established by professional inspectors using bespoke equipment.

And yet the employer is officially legally responsible for inspecting these documents…!

How do you check a Chinese passport?

In practice, day-to-day responsibility for the authentication of ID documents if often assigned to the HR department. As a consequence, HR staff may well be presented with an ID document they’ve never seen before. How, for example, would you authenticate a passport presented by a Chinese applicant? The Chinese passport has its own unique (security) features, including a watermark, an electronic data chip, and a UV feature, for example. The authenticity of a document can often be established on the basis of these features.

So which features should you look for? How, for that matter, would you establish if the individual in question requires a work permit? More often than not, it’s up to the HR department to answer these questions.

An ID document contains unique data. Think, for example, of the personal particulars (the holder’s name, date of birth, tax and social insurance number, etc) and the Machine Readable Zone or MRZ - a magnetic strip, usually located near the foot of the document, containing an alphanumeric code. This unique code is creating by applying an algorithm to the document data. Research has shown that more than 80% of all forgeries and counterfeits are uncovered because the MRZ code is incorrect.

Most people are familiar with only a small number of ID documents. While most employers will recognise a UK passport, few will be familiar with a Polish or Senegalese ID document. Another thing to bear in mind is that recognising a passport is not quite the same as spotting a counterfeit.

Help from the authorities?

To compensate for their inexperience and limited know-how, HR departments are encouraged to draw on the expertise of public-sector organisations such as the Home Office. Unfortunately such assistance doesn’t necessarily allow them to establish the authenticity of all ID documents they encounter. This is because public-sector organisations tend to focus on the inspection and verification of domestic ID documents. As a consequence, their experience is not always relevant to employers that recruit foreign staff.

Legal obligation to inspect and verify ID documents

To tackle identity fraud and illegal working, parliament passed the Law for Employers on Preventing Illegal Working in 2008. Under this law, employees are responsible for preventing illegal working, while the authorities are responsible for monitoring compliance. Employers who knowingly or otherwise recruit illegal workers risk a fine or even a prison term. This makes it all the more important that employers are in a position to inspect ID documents presented by (potential) employees.

The best and probably the only way to avoid illegal working is therefore to establish the identity of a potential employee before he or she is recruited. Ideally, the inspection and verification of ID documents forms part of the employee screening process, allowing the employer to meet its legal obligation to verify an applicant’s identity before offering him or her a contract.

Any employer that fails to comply could face a hefty fine. Indirect damage, including a loss of reputation, can also be substantial. Faced with these prospects, companies are understandably keen to avoid employing illegal workers. While many companies are eager to comply with current legislation, thereby avoiding illegal employment and related fines, few have found an appropriate solution yet.

The extent to which fraud involving counterfeit and stolen ID documents affects the corporate sector and society at large should not be underestimated. Identity fraud is part and parcel of everyday life - its scope increases each year, and the annual losses sustained by its victims run into billions of pounds. Identity fraud is increasingly common in the UK. According to the Association of Chief Police Officers (ACPO), fraud costs the UK taxpayer approximately £20 billion a year. Surprisingly, employees are among the worst culprits, putting employers in a particularly precarious position.

Last but not least: prevention better than cure

Embedding passport checks in the employee screening process allows you to establish the identity of an applicant, thus avoiding (fines for) employing illegal workers. Document checks can also act as a deterrent – a potential fraudster will think twice before applying to a company that verifies applicant identities as a matter of policy. Here too, prevention is better than cure. The development and implementation of internal recruitment procedures reduces recruitment-related risk and avoids illegal working. It also allows you to comply with prevailing legal requirements. The right combination of tools, software and reference materials should enable any organisation to conduct reliable checks.

10 practical tips when checking passports and ID cards

Only accept secure ID documents. In other words, documents that contain security features, such as passports and ID cards. Ask yourself whether a driving licence is acceptable. Generally speaking, these documents do not specify the holder’s nationality. Neither do they necessarily include a photograph. Documents that do not have security features, such as gas bills or bank statements, should never be accepted other than for address verification.

Always check the original ID document – do not accept copies. Make sure you copy or scan documents for your own records (remember to obtain the holder’s permission first).

Always follow the same inspection procedure and be mindful of details.

Always check more than one security feature.

Carefully compare the photograph in the document to the individual who presented it. Pay specific attention to the distance between the eyes, ears, lips and chin rather than the colour or length of his or her hair.

Ask the holder’s age and verify the answer based on the date of birth recorded in the document.

Check the document’s period of validity.

Check the document for damage, incisions and glue residue.

Check the order and number of visa pages. The page numbers must be sequential and should include the same document number.

Inspect the document under a UV lamp. Genuine documents remain dark when exposed to UV light; the watermark remains dark. Carefully compare the UV response or watermark to a reference image. Don’t forget: observing a UV response or watermark does not automatically mean the document is genuine!

Source: Keesing Reference Systems

Friday, 18 September 2009

Another Director Hit by FSA Fine as Powerchex Recommend

London, August 26th, 2009. The FSA has fined the director of an IFA for failing to disclose

that an approved person had lied about the reason for leaving their previous job.

The FSA fined Christopher Davies, Director of Newquay Investment Services Limited,

£17,500 because of an adviser at Newquay who posed an “unacceptable risk of customers

being recommended unsuitable mortgages”.

It was only after Newquay had applied to the FSA for the adviser to be confirmed as an

approved person that Davies became aware that the adviser’s previous employer had

suspended the adviser because of concerns about his business methods and ethics. Davies

spoke to the adviser and concluded that the adviser had lied to him about why he had left

his previous employment, but did not alert the FSA.

The news of the fine comes not long after the FSA fined Richard Holmes, Director of AIF

Limited, for failing to monitor an appointed representative and carry out sufficient

pre‐employment screening checks.

Director of Pre‐employment specialists Powerchex, Alexandra Kelly, believes that the FSA

will continue to crack down on firms but believes those that are most vigilant before hiring

people are the least likely to find themselves in hot water with the FSA.

Kelly said, “Newquay Investment Services Limited could have avoided the situation by

implementing proper pre‐employment screening practices. If they had known about the

advisor’s past before he joined the company they never would have hired the individual in

the first place and most certainly would not have put them forward for approved status. Our

research has shown that the recession has caused people to hide less desirable aspects of

their past and lie more so effective pre‐employment screening is becoming more and more

important.”

Wednesday, 19 August 2009

Judgement Call - Powerchex in the FT

THE CV SCREENER

Alexandra Kelly

We were recently asked to screen a job applicant on behalf of one of our clients. He was interviewing for a senior position in a big City institution working with large amounts of capital and sensitive information. He was highly experienced and sailed through the interviews and was subsequently offered the job, at which point his file ended up with my team.

At first glance, his CV and background seemed fine – absolutely nothing there that would cause for suspicion from even an experienced recruitment professional. However, it emerged that this supposedly “ideal candidate”, was in fact an international fraudster convicted of embezzlement in a number of US states.

Needless to say, most embellishments by applicants are not quite so extreme, and more often concern the job applicant who conceals that they were fired from their previous role, or who lies about their job responsibilities or the number of people they managed. However, all these scenarios serve to demonstrate that you can never, ever truly know whether an applicant really is exactly who they say they are. Unless, of course, you check.

The writer is managing director of Powerchex, a pre-employment screening company

Tuesday, 18 August 2009

HR, Facebook and Screening

The article first appeared in HR Zone at: : http://www.hrzone.co.uk/topic/hr-snooping-facing-facebook

What do you think?

_______________________________________________________

In a recent and high profile example of some of the issues associated with social networking sites, the wife of the recently appointed chief of MI6, Sir John Sawers, disclosed details of their personal life and address on her Facebook page, compromising their personal and, potentially, national safety.

There have also been recent examples of footballers and cricketers using Twitter to air their views about their employers. The blurring of the lines between private and public space, which is part of the social networking phenomenon, is key to the problem. These very public spaces have the capacity to threaten existing jobs, future careers, personal safety and corporate reputations as well as providing opportunities to contravene copyright and other laws. Organisations and individuals all have a role to play in managing the impact of social networking.

Reputational damage

An innocent exchange of wall postings on Facebook could lead to an employee breaching their contractual obligations by, for example, disclosing confidential information about a company's business or its clients. This could clearly have an adverse effect so an employer should investigate any allegations of this nature with a view to taking disciplinary action.

An employee who makes derogatory comments about their work, or their colleagues, on their profile could face disciplinary action as well as possible defamation or libel actions, not to mention the potential damage to the company's public image. Employers should consider carefully the type of conduct that warrants disciplinary action and make this clear to employees.

The way an employee behaves in their personal life may not be how their employer would like them to behave but, provided it does not impact their work or the company's reputation, then any disciplinary action would be inappropriate and any dismissal as a result could lead to a claim for unfair dismissal. So not everything an employee posts on their social networking site should have an impact on their employment.

Bullying and harassment

The ability to join work groups on networking sites creates the opportunity for 'banter' between colleagues. In extreme cases, this could lead to a complaint of bullying or harassment for which an employer may be vicariously liable for the actions of its employees, so complaints must be treated seriously and dealt with promptly. Employers need to be alert to these issues and the potential risks they pose.

Managing employer access when recruiting

Some employers have viewed the rise in the use of social networking sites as an opportunity to vet job applicants for their suitability. This can be a risky tactic as it exposes employers to potential discrimination claims. If an applicant who has not been offered a job discovers that their profile has been accessed as part of the recruitment process they could allege that information about their age, race, sex or religion displayed on their profile played a part in the decision to reject them.

While the company may have rejected them for a completely unrelated and fair reason, the existence of this information, which would be discloseable in litigation, will provide an additional hurdle to overcome in defending any claim. If employers do use this as a recruitment tool, then it is advisable to have a paper-trail setting out why a candidate was unsuccessful.

Managing employee access

In light of the issues posed by social networking sites, many employers have considered preventing access to such sites or monitoring employees' use. Each of these options presents its own issues and, despite the potential risks, these sites can be useful for building business networks - LinkedIn and Plaxo are designed for professional business relationships. Restricted use could, therefore, be preferable to a total ban.

In addition, employees could see a total ban as an overreaction by employers to what is an increasingly common form of communication. Banning staff from using the sites could lower morale, especially in industries where long hours are common and access for reasonable periods is used as a break from work.

To manage this issue, employers should consider monitoring employee's use to ensure it is being used appropriately. Recently, an employee who was claiming to be sick updated his Facebook page with the fact that he was absent due to a hangover. The employer used this as evidence against him in a disciplinary process.